Simplify your global expansion with our all-in-one platform. Hire, onboard, and pay talent in 180+ countries, all while staying 100% compliant with local laws. No entity setup required.

Global Talent Access

Hire in 180+ countries within minutes

Seamless Global Payroll

Pay in 120+ currencies with one click

Full Compliance & Support

One platform for contracts, benefits, and compliance

Off we go into the wild blue yonder

Your Global HR Partner, One Simple Solution

Expanding globally shouldn't mean expanding complexity. PayInOne transforms international HR management from a challenge into your competitive advantage.

From compliance and payroll to comprehensive HR management, we've got you covered. Our all-in-one platform empowers you to hire, manage, and grow your global team with confidence.

Streamline Your Global Workforce Management

Experience seamless integration of HR processes across borders. Our platform simplifies complex international workforce management into intuitive workflows.

Stay compliant with local regulations while maintaining global standards. Let us handle the complexity while you focus on growing your business.

Simplifying Global Employment

One Solution, Endless Possibilities

Transform your global workforce management with PayInOne's all-in-one platform. From onboarding to payroll, we streamline every aspect of employee management while ensuring full compliance across all regions.

Intelligent Automation

Our intelligent system automates essential HR processes including attendance tracking, leave management, expense claims, and performance incentives.

Global Compliance

Operating in full compliance with local employment laws and regulations in every jurisdiction we serve.

Complete Global Employment Solutions,

All-in-one Platform

Streamline your global workforce management with our comprehensive suite of tools and services

Countries Supported

Active Personnel

Partner Companies

Employer of Record

Employ qualified talents through PayInOne's global infrastructure, allow us to share responsibilities and alleviate your concerns.

Active Employees

No Entity Setup Needed

Hire globally without establishing local entities

Compliance Management

Full legal compliance and risk management

HR Administration

End-to-end employee lifecycle management

Implementation Progress

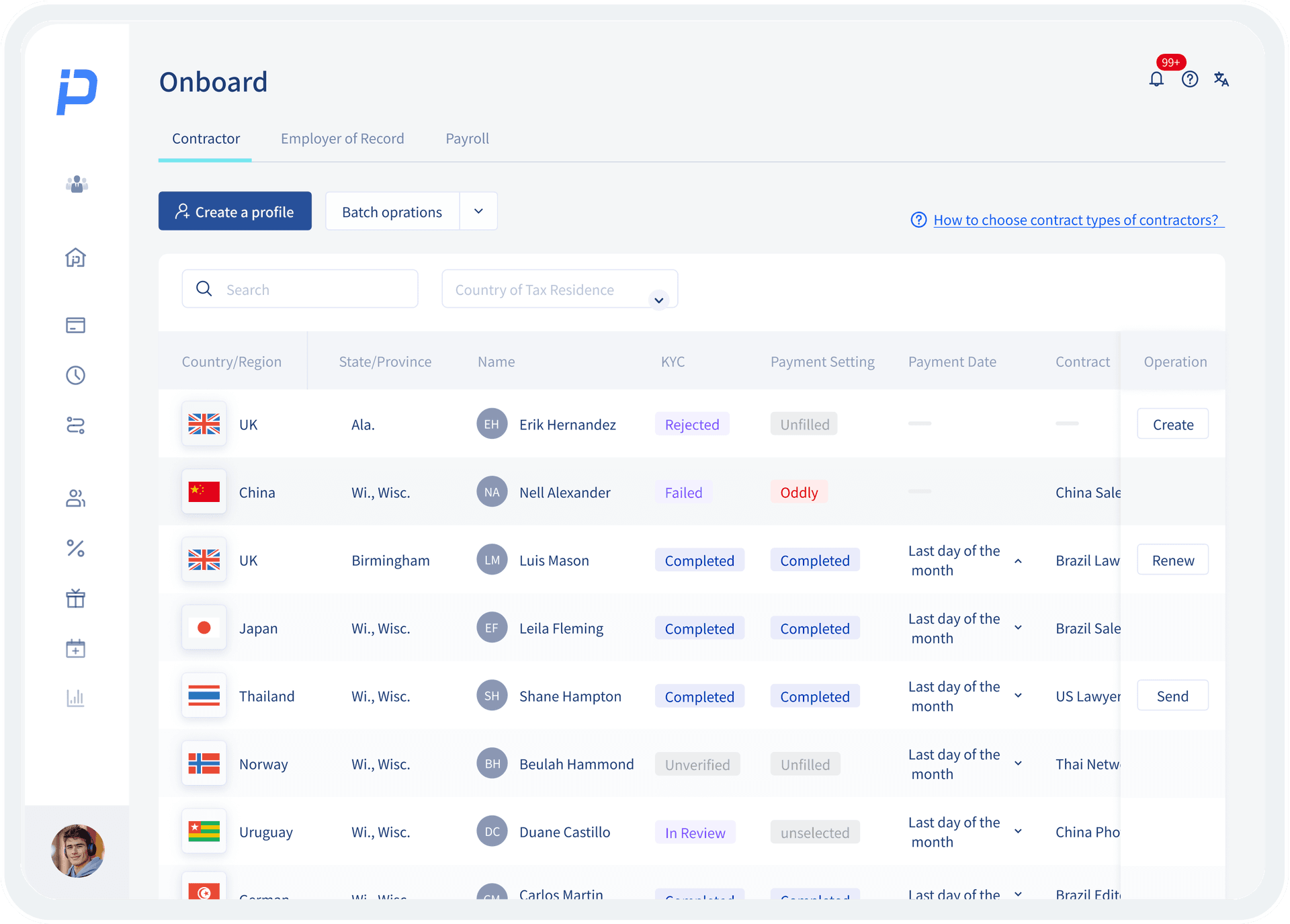

ActiveHire Contractors

Feel free to apply PayInOne's agreement for contractors, set flexible working periods at adjustable rates, and benefit from automated invoicing.

Contract Management

Streamlined contract creation and management for global teams

Automated Payments

Hassle-free payment processing across multiple currencies

Global Compliance

Stay compliant with local contractor regulations worldwide

Performance Tracking

Monitor and optimize contractor performance efficiently

PayInOne Resource Center

Your comprehensive hub for global employment resources and tools

Build a strong foundation for your global expansion with our expert-backed resources and insights.

Join hundreds of successful businesses who have trusted our expertise to navigate their international growth journey.

Every talent you need in every country you hire.

Hire and manage global talent in over 180 countries in minutes. We handle compliance, payroll, and benefits, ensuring a seamless experience for both you and your international team members.

Our customers are the reasons why we are here

Hire and Pay Teams Globally

Your Global Hiring & Compliance Partner

Hire anyone, anywhere. We handle global payroll, compliance, and HR so you can focus on growing your business worldwide.

0+

Countries and regions supported

0+

Global offices worldwide

0M+

Monthly payroll processed

0+

Years industry experience